ShareChat is in remaining phases of deliberations to safe about $50 million in new funding that trims the startup’s valuation to beneath $1.5 billion, in accordance with two sources accustomed to the matter.

Current backers together with Temasek and Tencent are among the many traders in superior phases of talks to put money into the brand new spherical, the sources stated, requesting anonymity because the matter is non-public. ShareChat has had discussions with a number of potential new traders this 12 months, however many have balked on the alternative as a consequence of ShareChat’s excessive valuation expectations relative to their at the moment low income, in accordance with one of many new traders the startup engaged with.

The phrases of the talks, that are nonetheless ongoing so they might barely change, at the moment worth ShareChat beneath $1.5 billion, the sources stated, a steep drop from the $4.9 billion valuation at which ShareChat raised funding early final 12 months.

A spherical might finalize as early as finish of the 12 months. Temasek and ShareChat didn’t instantly reply to a request for remark Wednesday morning.

The loss-making Bengaluru-headquartered startup — which operates a social network and counts X, Snap and Tiger International amongst its backers — has raised greater than $1.4 billion thus far, in accordance with enterprise intelligence platform Tracxn.

ShareChat’s failed wager on the Indian short-video house amid the TikTok ban has compelled a hunt for funds and prompted the markdown. (In late 2020 and early 2021, X explored shopping for ShareChat in a $2 billion deal, TechCrunch exclusively reported earlier.)

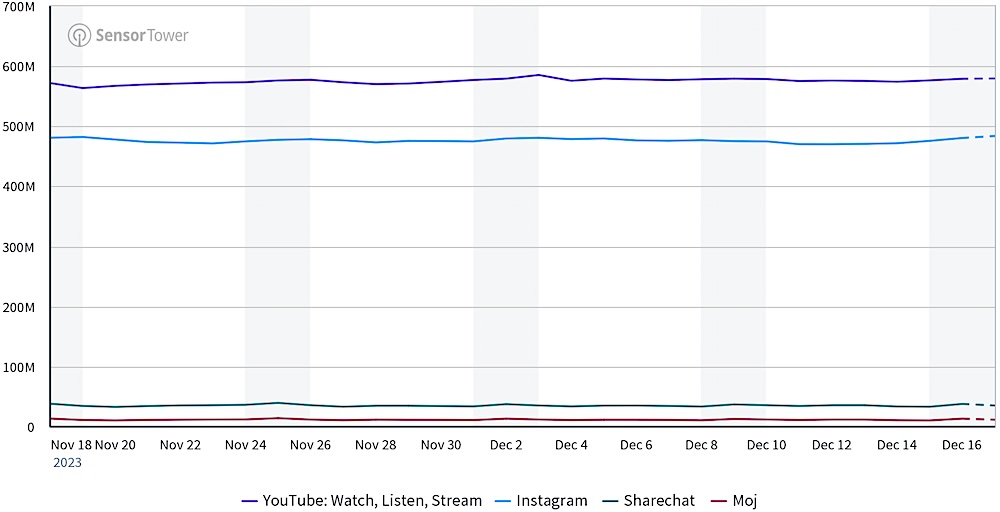

Each day lively customers on Google’s Android platform in India, per Sensor Tower’s estimates. In public statements, ShareChat claims it has over 300 million month-to-month lively customers.

ShareChat, which launched the short-video app Moj in mid-2020, doubled down on the class by acquiring MX TakaTak, a video app in Occasions Web’s portfolio, for over $600 million; nonetheless trade analysts say YouTube and Instagram stuffed the TikTok void as creators migrated to these far bigger platforms.

Eight-year-old ShareChat, whose two co-founders left earlier this 12 months to launch a brand new startup, has been scrambling to seek out methods to develop its income and trim bills. It has tried a collection of initiatives, together with a fantasy sports app and a reside audio chat service. However on the finish of monetary 12 months ending March, its income remained beneath $65 million. It plans to scale back its workforce by one other 15% to twenty% within the coming weeks, in accordance with one other particular person accustomed to the matter.

Quite a few traders are writing down the price of their holdings in startups globally amid the protracted slowdown in economic system that has additionally reduce quick the valuations of almost each public tech agency. Prosus not too long ago marked down the valuation of Byju’s to below $3 billion, down from $22 billion in early 2022. Byju’s has raised greater than $5 billion in fairness and by way of debt through the years.