Realtors see dwelling costs regaining pandemic peaks as soon as Canadians settle for the ‘new regular’ in borrowing charges

Article content material

Article content material

Home prices should climb again to pandemic peaks by this time subsequent 12 months, says a brand new report that surveyed actual property brokers throughout the nation.

Royal LePage predicts that the mixture worth of a house in Canada will rise 5.5 per cent 12 months over 12 months by the top of 2024 to $843,684.

“Based on this forecast, by the end of next year, home prices will have essentially climbed back to their pandemic peak, reached in the first quarter of 2022,” mentioned the report.

Commercial 2

Article content material

However first there’s the “great adjustment.”

For the previous 4 years Canada’s housing market has been on a “roller coaster,” realtors say.

After gross sales tanked throughout pandemic lockdowns, consumers flooded again to the market enticed by low cost borrowing charges. The spike in demand pushed costs to unprecedented highs. On the peak of the growth in February 2022, the typical worth hit $816,720, in response to figures from the Canadian Actual Property Affiliation.

Enter the Bank of Canada. Probably the most aggressive interest rate hiking cycle in current reminiscence despatched the market into an prolonged correction, that, however for a quick rally this previous spring, continues immediately.

Patrons, discouraged by increased borrowing prices, stay on the sidelines and inventories are constructing throughout the nation. Although gross sales are down to twenty to 30 per cent in some areas, the decline in dwelling costs is modest, mentioned Royal LePage.

“Looking ahead, we see 2024 as an important tipping point for the national economy as the majority of Canadians acknowledge that the ultra-low interest rate era is dead and gone,” mentioned Phil Soper, chief govt of Royal LePage.

Article content material

Commercial 3

Article content material

“We believe that the ‘great adjustment’ to tolerable, mid-single-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.”

For a lot of Canadians that adjustment will probably be nice certainly.

Although the Financial institution of Canada’s present 5 per cent coverage fee is much beneath the double-digit extremes of the Eighties and ’90s, it’s nonetheless a lot increased than many Canadians are used to.

For the reason that nice monetary disaster in 2009, the Financial institution’s benchmark fee didn’t exceed 1.75 per cent till March 2022. Greater than decade of near-bottom charges preceded this newest climbing cycle.

Royal LePage pegs the brand new regular for mortgage rates at 4 to 5 per cent — a good bit above the 2021 low of 1.4 per cent.

“For the last year, many Canadians have been fixated on the idea of interest rates needing to come down significantly before they can afford to enter or re-enter the housing market,” mentioned Soper.

“Acceptance that a mortgage rate of four to five per cent is the new normal should untether pent-up demand as first-time buyers, flush with savings collected during the extended down market in housing, regain the confidence to go home shopping.”

Commercial 4

Article content material

That isn’t prone to occur till the second half of 2024, when Royal LePage predicts the Financial institution of Canada will start to slowly ease rates of interest in late summer season or fall. Their forecast is later than many economists and markets who see cuts coming as early as March or April.

The third quarter will see the most important features, with dwelling costs rising 3.3 per cent 12 months over 12 months. By the fourth quarter costs will probably be up 5.5 per cent.

Regionally, Calgary home prices will lead features with an 8 per cent enhance by the top of 2024.

“We expect that home prices will rise over the next year, and will outperform other major cities as Calgary’s relative affordability continues to attract buyers to the city,” mentioned Royal LePage dealer Corinne Lyall.

Affordability will stay a problem in markets similar to Toronto where home prices are anticipated to rise 6 per cent to $1,198,012.

“We know there are still buyers on the sidelines waiting for interest rates to come down. What is unclear is how many can afford to jump back into the market at the first sign of a reduction, and how many truly cannot afford to transact in this environment,” mentioned Karen Yolevski, chief working officer, of Royal LePage Actual Property Providers.

Commercial 5

Article content material

Good points will probably be much more modest in Vancouver, Canada’s most expensive housing market. By the top of 2024 the mixture worth may have risen 3 per cent to $1,281,732, says the forecast.

_____________________________________________________________________

Was this text forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

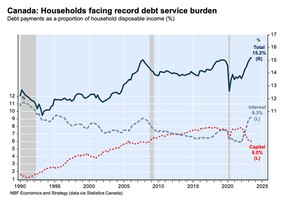

Extra proof of the rising weight of rates of interest on Canadians.

The family debt service ratio, which measures the proportion of disposable revenue dedicated to debt funds, reached a file excessive of 15.2 per cent in information going again to the early Nineteen Nineties.

Over the previous six quarters because the Financial institution of Canada raised its benchmark fee, curiosity funds have risen from 5.9 per cent of disposable revenue to 9.3 per cent, the best degree since 1995, says economists with Nationwide Financial institution of Canada.

“The fact remains that new homeowners will have to renew their mortgages at higher rates in the coming quarters,” mentioned Nationwide Financial institution economist Daren King.

Commercial 6

Article content material

“This means that the interest payment shock is not over and represents a headwind for the economy over the coming year.”

- Right this moment’s Information: Canada’s manufacturing unit gross sales, U.S. retail gross sales, commerce worth indices and enterprise inventories

- Earnings: Empire, Costco Wholesale

Get all of immediately’s prime breaking tales as they occur with the Financial Post’s live news blog, highlighting the enterprise headlines it’s essential to know at a look.

The megacaps are getting loads of consideration as a result of they proceed to develop regardless of being largely priced to perfection. Portfolio supervisor Martin Pelletier says that dynamic might be troublesome if an organization’s inventory’s worth doesn’t match its capability to realistically meet everybody’s expectations. Read more from FP Investing

Associated Tales

Right this moment’s Posthaste was written by Pamela Heaven, @pamheaven, with extra reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at [email protected], or hit reply to ship us a be aware.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material