Many planning to rework how they store and eat to search out some much-needed aid

Article content material

Canadians who spent the previous yr watching their grocery bills climb ever larger look like resigned to much more ache forward in 2024, however they’re additionally planning to combat again.

Article content material

Simply over 80 per cent of Canadians assume food prices will proceed to rise subsequent yr, in line with a brand new report from the Agri-Meals Analytics Lab at Dalhousie College, in partnership with Caddle. Many anticipate staple objects to be hit exhausting, with virtually three-quarters predicting meat costs will soar, whereas 62.2 per cent assume they’ll be paying extra for fruit and veggies. One other 42.1 per cent consider costs of dairy merchandise, equivalent to milk, cheese and butter, will spike.

Commercial 2

Article content material

However simply because folks anticipate larger costs doesn’t imply they aren’t plotting methods to save cash. Many are planning to rework how they store and eat to search out some much-needed aid on their grocery payments.

“Canadians are adapting in diverse ways to manage their food expenses,” Sylvain Charlebois, director of the Agri-Meals Analytics Lab, stated in a launch. “This change is more than just economic; it’s a cultural shift in how we approach our food choices and consumption patterns.”

For instance, a technique persons are planning to manage is by purchasing gross sales, and greater than 40 per cent say they’ll put extra deal with promotions within the new yr. One other 34.6 per cent plan to make use of coupons to manage prices, whereas 33.6 per cent say they’ll make extra use of loyalty applications, a few of which permit prospects to trade factors for reductions on grocery payments.

One-third of Canadians additionally aren’t against switching meals shops if it means discovering a greater deal, the survey stated. However in addition they seem to want an excellent cause to buy someplace new, and can solely accomplish that if they are often wooed by decrease costs, higher grocery high quality or location.

Article content material

Commercial 3

Article content material

On the identical time, many plan to save cash by slicing down on meals waste, both by means of meal planning, utilizing up leftovers, stocking freezers and even canning meals. That would translate into substantial financial savings; thrown-out meals prices the common family $1,300 a yr, in line with Nationwide Youth Council estimates. In all, $20-billion price of meals, or 2.3 million tonnes, will get trashed throughout Canada yearly.

Persons are additionally experiencing sticker shock when eating out, and a few intend to chop again on restaurant journeys. Nearly 40 per cent say they’ll eat out much less subsequent yr and 12.2 per cent plan to give up eating places utterly. Of those that do exit to eat, 39.4 per cent say they’ll be sure that cheaper choices are on the menu.

Meals inflation has slowed in current months. In November, grocery prices increased by 4.7 per cent, Statistics Canada stated on Dec. 19. That’s slower than in October, when meals costs rose 5.4 per cent, and far cooler than the height of 11.4 per cent in September 2022. Nonetheless, costs of some merchandise rose extra on a yearly foundation in November than they did in October, together with meat, up 5 per cent, preserved greens, up 5.8 per cent, and sugar and confectionary objects, up 8.3 per cent.

Commercial 4

Article content material

After all, slower value will increase don’t essentially translate into decrease meals payments. “Food is significantly more expensive than it was a year or two ago,” Michael Von Massow, a professor of meals economics on the College of Guelph, lately informed the Monetary Submit’s Larysa Harapyn. “Even in the absence of price increases, we know that people are still feeling the pinch.”

Sign up here to get Posthaste delivered straight to your inbox.

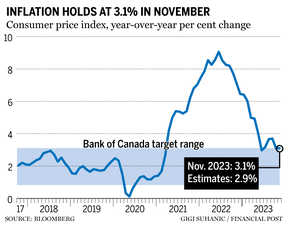

The rate of inflation stalled in November stunning economists and giving the Financial institution of Canada one more reason to maintain rates of interest on maintain.

The buyer value index rose by 3.1 per cent in November from a yr in the past, matching the rise a month earlier, Statistics Canada reported Dec. 19. That’s sooner than the median estimate of two.9 per cent in a Bloomberg survey of economists.

On a month-to-month foundation, the index rose 0.1 per cent, versus expectations for a lower of 0.1 per cent.

Mortgage curiosity prices stay the most important upside contributor to the patron value index, with the inflation price excluding these prices sitting at 2.2 per cent in November. Excluding shelter prices solely, that determine is 1.9 per cent.

Commercial 5

Article content material

- The Financial institution of Canada releases its abstract of deliberations for its Dec. 6 rate of interest determination.

- Right now’s information: U.S. present account, current residence gross sales, Convention Board shopper confidence index

- Earnings: BlackBerry Ltd., Basic Mills Inc.

Get all of as we speak’s prime breaking tales as they occur with the Financial Post’s live news blog, highlighting the enterprise headlines you must know at a look.

The vacation season is usually when some corporations give their workers a token of their appreciation. However generally these items usually are not price as a lot as they appear since they is likely to be taxable. Tax expert Jamie Golombek breaks down what sorts of items don’t entice the taxman.

Right now’s Posthaste was written by Victoria Wells, with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at [email protected].

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material