Robinhood’s long-awaited worldwide enlargement is at full throttle. The patron buying and selling and funding app tailor-made to the youthful generations is launching its crypto app to all eligible customers within the European Union, the corporate said Thursday.

The announcement comes on the heels of its foray into the U.K. only a week in the past. Whereas it’s taking crypto buying and selling to EU prospects, it’s solely making its brokerage service out there within the U.Okay. for now.

The EU has been on the forefront of formulating rules to implement the traceability of crypto for anti-money laundering and defending retailers from market volatility. Among the many most vital frameworks is the Markets in Crypto-Assets (MiCA) rule, which focuses on stablecoin regulation and is seen as one of many world’s most complete regimes for crypto property.

“The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans,” Johann Kerbrat, common supervisor of Robinhood Crypto, mentioned in an announcement.

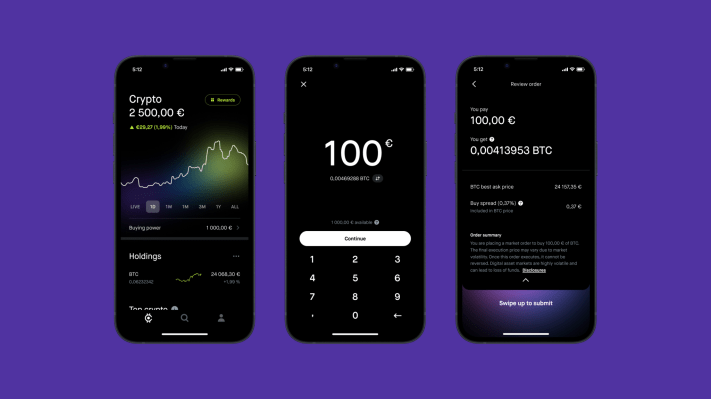

Apart from boasting low charges, Robinhood claims it’s the one custodial crypto platform — the place buyer funds lie within the custody of the trade quite than their self-hosted wallets — will get a share of their buying and selling quantity again each month, paid in Bitcoin. Customers within the EU can purchase and promote some 25 cryptocurrencies, together with main ones like Bitcoin and Ethereum.

Robinhood is taking different measures to guarantee European customers that they’re getting their cash’s value, given its previous enterprise practices have been lower than preferrred. Within the U.S., the Securities and Alternate Fee has criticized the inventory buying and selling app for deceptive customers about the way it makes cash and failing to ship its promise of the perfect execution of trades. It ended up paying $65 million to settle these SEC fees.

In its crypto endeavor within the EU, Robinhood guarantees transparency by displaying the buying and selling unfold, which incorporates the rebate it receives from promote and commerce orders within the app.

It additionally ensures it is going to by no means commingle buyer cash with enterprise funds apart from for working functions, equivalent to cost of community charges. Within the aftermath of FTX’s collapse, customers are more and more cautious of centralized, custodial crypto platforms and switching to decentralized alternatives.

Robinhood itself has been skittish about its crypto operations. In June, it voluntarily moved to limit the trading and holding of certain tokens for its U.S. prospects, at a time when the federal government was taking a firmer stance in opposition to buying and selling giants like Binance and Coinbase.

The Robinhood Crypto app, out there on iOS and Android beginning at the moment, is restricted to European residents who’re over 18 years previous. The platform has plans to incorporate extra tokens and add new options like crypto transfers, staking and studying rewards in 2024.