Financial institution of Canada would solely have needed to elevate charge to three% if authorities spending hadn’t stoked inflation, say economists

Article content material

Article content material

Canadians will get a take a look at how Ottawa is managing its cash when Finance Minister Chrystia Freeland unveils the fiscal replace tomorrow.

However in accordance with these economists, if governments hadn’t spent so freely, interest rates on this nation can be lots decrease.

Scotiabank Global Economics calculates that 200 foundation factors (two proportion factors), of the Bank of Canada’s present 5 per cent rate of interest had been wanted to counteract the results of presidency spending and Federal pandemic aid to households.

Commercial 2

Article content material

“There is no question in our minds that fiscal policy has complicated the task of monetary policy in Canada,” mentioned chief economist Jean-François Perrault and René Lalonde, director of modelling and forecasting.

“Interest rates are substantially higher than they would be had government consumption spending at all levels of government remained fixed in relation to GDP.”

Since 2019 authorities spending has risen quicker than GDP growth on all ranges, mentioned their report. That surge and Federal aid throughout the pandemic pumped stimulus into the economic system that fuelled inflation. With out this, the Financial institution of Canada would solely have wanted to boost its charge to three per cent.

“This has had a large impact on the economy. Put in a monetary policy context, the economy would not have been in excess demand were it not for this surge in government spending,” they mentioned.

The economists calculate that authorities spending accounted for 120 foundation factors of the 475 bps the central financial institution has raised its charge since March 2022. Provincial spending was answerable for 70 bps of that, the Federal authorities 30 bps and municipalities and different ranges of governments 20 bps.

Article content material

Commercial 3

Article content material

COVID-19 aid to households accounts for about 80 bps, bringing the full influence to 2 proportion factors.

The economists acknowledged the necessity for some enhance in spending. Calls for on authorities providers have risen lately to deal with progress within the inhabitants and the rising variety of aged Canadians.

“Some of the rise in government consumption of goods and services was likely desirable and necessary given population growth and ageing but those expenditures were inconsistent with inflation control and led to higher interest rates,” they mentioned.

Fiscal coverage is usually a highly effective software to fight financial shocks, however it might probably additionally trigger issues when that assist is simply too massive or goes on too lengthy, mentioned the report.

“This was definitely the case in Canada. Real government spending rose much more rapidly than real GDP since late 2019. There was nothing temporary about the surge in government consumption,” they mentioned. “Pandemic transfers, on the other hand, were temporary but extremely large and kept in place too long.”

Scotiabank is the newest to flag issues that authorities spending is making the Financial institution of Canada’s job more durable.

Commercial 4

Article content material

A survey by Bloomberg discovered {that a} majority of economists mentioned Ottawa’s beneficiant spending applications and higher immigration targets have contributed to a necessity for larger rates of interest.

Financial institution of Canada Governor Tiff Macklem has additionally urged lawmakers in Ottawa to contemplate how their spending will influence inflation.

At its final assembly in October, members of the Bank’s governing council noted that spending plans for federal and provincial governments in 2024 “could get in the way of returning inflation to target.”

Scotiabank economists say their analysis means that fiscal coverage has been “badly mis-calibrated” for the reason that pandemic relating to inflation administration — and all ranges of presidency are answerable for this.

“We quite literally cannot afford to repeat these errors in upcoming budgets,” mentioned Perrault and Lalonde.

_____________________________________________________________________

Was this article forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Commercial 5

Article content material

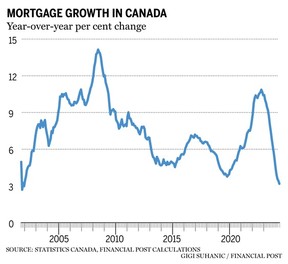

In one other signal of Canada’s slumping housing market, knowledge out Friday exhibits that mortgage growth is the slowest it’s been in additional than 20 years.

Mortgage debt rose 3.2 per cent from a 12 months earlier to $2.14 trillion in September, the weakest tempo of progress since 2001, mentioned Statistics Canada.

That’s down from as excessive as 10.9 per cent originally of 2022, making it one of many quickest decelerations in credit score progress in knowledge going again to the early Nineteen Nineties.

— Bloomberg

- Right now’s Information: Canada building funding, Bloomberg Nanos Confidence, U.S. main indicators

- Earnings: Agilent Applied sciences, Keysight Applied sciences, Zoom Video Communications

Get all of right now’s high breaking tales as they occur with the Financial Post’s live news blog, highlighting the enterprise headlines it is advisable to know at a look.

_______________________________________________________

Commercial 6

Article content material

Inventory choice proceeds are thought of employment revenue, so it’s important to pay your share of Canada Pension Plan contributions on them even for those who’re retired, and that will have an effect on your choice on when to take CPP. Licensed monetary planner Andrew Dobson helps one reader out who finds himself in that very scenario. Get the answer

Associated Tales

____________________________________________________

Right now’s Posthaste was written by Pamela Heaven, @pamheaven, with extra reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at [email protected], or hit reply to ship us a be aware.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve enabled e-mail notifications—you’ll now obtain an e-mail for those who obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on modify your email settings.