Knowledge reveal impacts of most aggressive interest-rate mountaineering in latest historical past

Article content material

Article content material

Trying again on the 12 months the Bank of Canada began mountaineering rates of interest, issues appeared fairly good.

Canada’s actual gross home product grew 3.8 per cent in 2022, with GDP rising in nine provinces. Saskatchewan led the pack with 6 per cent development, adopted by Alberta, at 5 per cent, based on provincial numbers launched final week by Statistics Canada.

However whereas development appeared good on the floor, Marc Desormeaux, principal economist at Desjardins, spots a number of “troubling details” in the data that confirmed the early impacts of essentially the most aggressive interest-rate hiking cycle in latest historical past.

Commercial 2

Article content material

In an effort to curb hovering inflation after the pandemic, the Financial institution of Canada raised its coverage rate of interest from 0.25 to 4.25 per cent in 2022. Three extra fee hikes in 2023 introduced the speed to the present 5 per cent.

“We already knew how much of a drag housing posed at the national level last year as interest rates rose sharply, but the breadth of weakness and depth in some regions was striking,” mentioned Desormeaux in a word.

After hitting record-highs in 2021, housing investment dropped 12.1 per cent in 2022, falling in seven provinces, a depend solely exceeded throughout extreme recessions previously, he mentioned.

Residential capital’s share of financial output in 2022 was under the common of the last decade earlier than the pandemic in all places besides within the Maritimes.

In Ontario, Quebec and British Columbia, this funding fell by greater than at any level for the reason that Nineties.

In Ontario and B.C., the economies the place the housing market holds the most important sway, development would have been over 5 per cent if it was not for the decline in actual property, mentioned Desormeaux. Because it was, 2022 GDP for Ontario got here in at 3.9 per cent and three.8 per cent for B.C.

Article content material

Commercial 3

Article content material

Dwelling gross sales in these two provinces fell sharply as rates of interest climbed. When the Financial institution of Canada paused charges at 4.50 per cent in early 2023, the market skilled a strong restoration that stunned economists. Nonetheless, the decline resumed when the Financial institution hiked charges once more in June and July, bringing the speed to five per cent.

Rates of interest have been on pause since then, however Desjardins sees much less likelihood of a rebound this time.

Greater borrowing prices have made the housing market much more unaffordable, and the “higher for longer” narrative from central banks will maintain fastened mortgage charges elevated till the Financial institution of Canada cuts charges subsequent 12 months, mentioned Desormeaux.

One other warning signal from 2022 was financial savings charges. The pile of cash Canadians put away in the course of the pandemic initially shielded customers from the consequences of excessive inflation and rates of interest, however there have been already indicators that 12 months that that defence was weakening.

Canada’s family saving fee dropped from 10.5 per cent in 2021 to five.4 per cent in 2022, as increased spending exceeded positive factors in revenue, mentioned Statistics Canada.

Commercial 4

Article content material

Ontario noticed the steepest decline, falling to three.2 per cent, primarily due to increased curiosity funds.

“In fact, households in this province had the highest debt service ratio in the country (8.1 per cent compared with 6.8 per cent for Canada), mainly because of increases in mortgage debt,” mentioned Statistics Canada.

In the meantime, Saskatchewan was the one province that noticed its financial savings fee enhance, rising to eight.7 per cent as incomes had been boosted by improved crop situations and better grain costs.

Although the provincial GDP information is a 12 months behind, it nonetheless gives “critical takeaways” for development in 2023 and past, mentioned Desormeaux.

The drag from the housing market and dangers of better monetary stress in closely indebted areas resembling Ontario and British Columbia reinforces Desjardins’ view that oil-producing provinces resembling Alberta are greatest positioned to climate the downturn.

_____________________________________________________________________

Was this text forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Commercial 5

Article content material

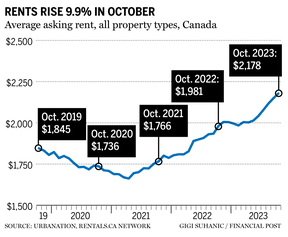

The data simply maintain coming in Canada’s rental market. The common asking worth for a rental unit has hit new highs now for six months in a row, topping at $2,178 in October.

Vancouver remains to be the most costly metropolis for renters, with the common one-bedroom itemizing at $2,872, nearly 7 per cent increased than final 12 months. Toronto is an in depth second with a one-bedroom fetching $2,607.

However nationwide hire inflation is definitely being fuelled primarily by worth will increase in Alberta, Quebec and Nova Scotia. Hire in Calgary has jumped 14 per cent 12 months over 12 months to $1,733.

Ontario confirmed the slowest annual development in residence rents throughout October, rising 4.6 per cent to $2,492, mentioned the info launched by Rentals.ca and Urbanation Monday.

- John Graham, chief govt of CPP Investments, will ship an replace on the efficiency of the Canada Pension Plan Fund in Calgary, adopted by a fireplace chat with Deborah Yedlin of the Calgary Chamber of Commerce.

- Open Textual content Company takes half within the RBC Capital Markets World Know-how, Web, Media and Telecommunications Convention in New York

- Right now’s Knowledge: U.S. client worth index and NFIB Small Enterprise Financial Tendencies Survey

- Earnings: CAE, Dwelling Depot, Birchcliff Power, Premium Manufacturers Holdings

Commercial 6

Article content material

Get all of right now’s high breaking tales as they occur with the Financial Post’s live news blog, highlighting the enterprise headlines it is advisable know at a look.

_______________________________________________________

Retirement is the top of most Canadians’ monetary plans. However the monetary trade’s emphasis on investing means there could be a tendency to miss different methods that may make retirees higher off once they cease working. Monetary planner Jason Heath outlines six of these that may make it easier to obtain the perfect retirement doable.

Associated Tales

____________________________________________________

Right now’s Posthaste was written by Pamela Heaven, @pamheaven, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at [email protected], or hit reply to ship us a word.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve got enabled electronic mail notifications—you’ll now obtain an electronic mail for those who obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on learn how to regulate your email settings.