Reaching the financial institution’s 2% inflation goal may not be obligatory, Desjardins economists say

Article content material

The Bank of Canada may begin slicing rates of interest earlier than inflation reaches its two per cent goal, however provided that the labour market co-operates, economists at Desjardins Group say.

Article content material

A balancing within the labour market that brings the unemployment fee to six.5 per cent mixed with an inflation fee at or beneath three per cent is probably going the magic formulation that prompts a Bank of Canada interest rate cut, Desjardins economists Royce Mendes and Tiago Figueiredo mentioned in a be aware on Nov. 20.

Commercial 2

Article content material

If the financial system stays on its present path, that transfer to chop charges may occur as quickly because the second quarter of 2024. The Financial institution of Canada’s key coverage fee is sitting at 5 per cent, the very best degree in 22 years.

Mendes and Figueiredo mentioned policymakers are carefully watching the labour market for indicators of rebalancing, and eyeing particularly the vacancy-to-unemployed ratio — a measure of job openings versus unemployed individuals — for clues as to when that can occur. Vacancies have been falling simply because the variety of individuals with out jobs rises, bringing the present ratio to simply above 0.5, a degree final seen earlier than the pandemic. That ratio is anticipated to fall to 0.5 early subsequent 12 months if job openings hold declining and unemployment continues to rise. At that time, unemployment shall be at about six per cent, the economists mentioned.

However that also received’t be sufficient to immediate a fee reduce, with bankers desirous to “err on the side of caution so they don’t ease prematurely,” Mendes and Figueiredo mentioned. Which means the financial institution will need to wait till the vacancy-to-unemployed ratio hits 0.4, which might quantity to a 6.5 per cent unemployment fee. Wage pressures may also be weaker at that time, they mentioned.

Article content material

Commercial 3

Article content material

After all, the inflation rate additionally performs a crucial function within the choice to chop rates of interest. An easing of labour market situations is strongly correlated with lower cost pressures, the economists mentioned, serving to to drive the speed of inflation at or beneath three per cent, which continues to be in need of the financial institution’s two per cent goal. However the economists mentioned the Financial institution of Canada may not trouble ready till the 2 per cent goal materializes to carry charges decrease, because of the outsized influence of shelter prices on inflation.

The Financial institution of Canada expects housing costs to drive inflation for the following six months. Dejsardins forecasts concur, exhibiting that shelter will weigh closely on inflation properly into 2024. However as a result of shelter prices can solely enhance with a rise in housing provide, which can take a while to realize, the Financial institution of Canada might exclude shelter prices from its inflation studying completely.

“The fact that central bankers view this as a supply problem, not a demand issue which they can control, is key to understanding why governor (Tiff) Macklem finally said what we’ve been forecasting for some time: the central bank will not wait for reported inflation to reach two per cent to cut interest rates,” the economists mentioned.

Commercial 4

Article content material

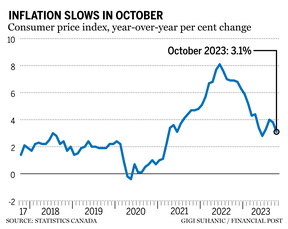

The annual fee of inflation slowed in October, coming in at 3.1 per cent versus 3.8 in September, Statistics Canada mentioned on Nov. 21. Desjardins forecasts inflation to proceed on its downward development, reaching the Financial institution of Canada’s two per cent goal by 2025.

Nonetheless, if the labour market reaches an unemployment fee of 6.5 per cent and inflation eases to round three per cent, Desjardins expects the Financial institution of Canada to chop rates of interest within the first half of 2024. Each these standards may very well be met as early as April, the economists mentioned.

“Assuming BOTH of our thresholds are met, the Bank of Canada could begin trimming rates in the second quarter of 2024 to better calibrate policy to the reality the central bankers will have done what they can to conquer inflation,” Mendes and Figueiredo mentioned. “What’s left to hit two per cent will just be time.”

Sign up here to get Posthaste delivered straight to your inbox.

Inflation cooled in Canada in October, coming in at 3.1 per cent on a year-over-year foundation, in comparison with 3.8 per cent in September, Statistics Canada mentioned Tuesday.

The drop got here as the value drivers paid for gasoline in October fell 7.8 per cent from a 12 months earlier, in contrast with a 7.5 per cent improve in September.

Commercial 5

Article content material

Excluding gasoline, the buyer worth index was up 3.6 per cent for October, following a 3.7 per cent improve for September.

The most important contributors to inflation for the month continued to be mortgage curiosity prices, meals bought from shops and hire.

Whereas grocery costs continued to rise quicker than general inflation, their tempo of will increase continued to gradual. Grocery costs have been up 5.4 per cent in October in contrast with a 5.8 per cent transfer larger in September.

- Financial institution of Canada governor Tiff Macklem will communicate earlier than the Saint John Area Chamber of Commerce this morning at 11:45 a.m. ET.

- The inaugural Indigenomics on Bay Avenue Convention, a nationwide Indigenous economy-focused convention, takes place in Toronto beginning in the present day and working till Nov. 23.

- Yukon’s finance minister will inform Yukoners concerning the ongoing progress and improvement of the 2022 to 2023 Public Accounts.

- Immediately’s information: U.S. preliminary jobless claims for week of Nov. 18, sturdy items orders, College of Michigan client sentiment index

- Earnings: Deere & Co.

Get all of in the present day’s high breaking tales as they occur with the Financial Post’s live news blog, highlighting the enterprise headlines you must know at a look.

Commercial 6

Article content material

Associated Tales

The Canada Income Company continues to be reviewing greater than 1,000 circumstances associated to COVID-19 pandemic advantages paid out by the federal authorities. The crux is usually whether or not a taxpayer beforehand earned sufficient cash to qualify for the advantages, and figuring out that, as tax expert Jamie Golombek points out, isn’t so simple as you would possibly assume.

Immediately’s Posthaste was written by Victoria Wells, with extra reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at [email protected].

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material